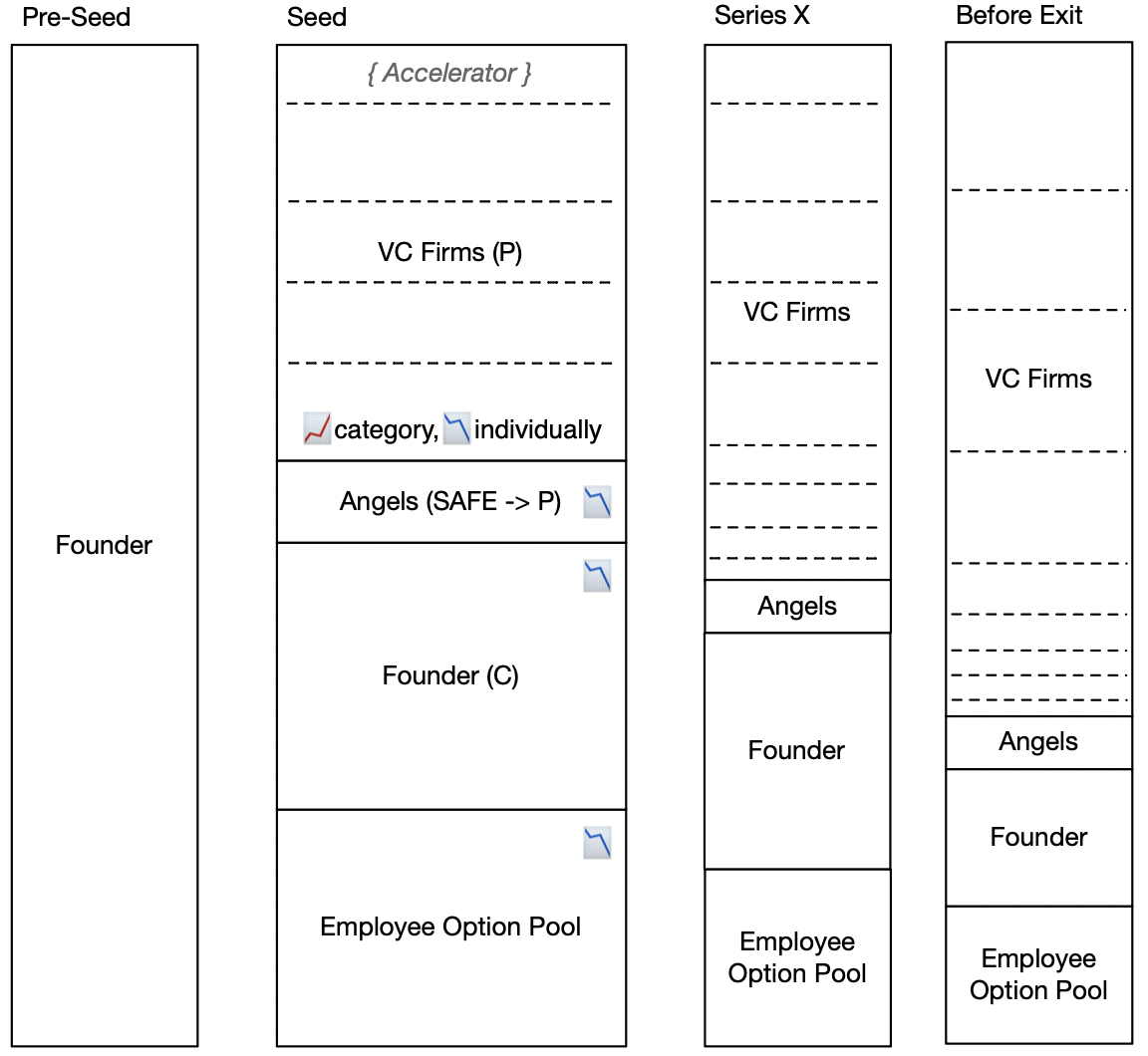

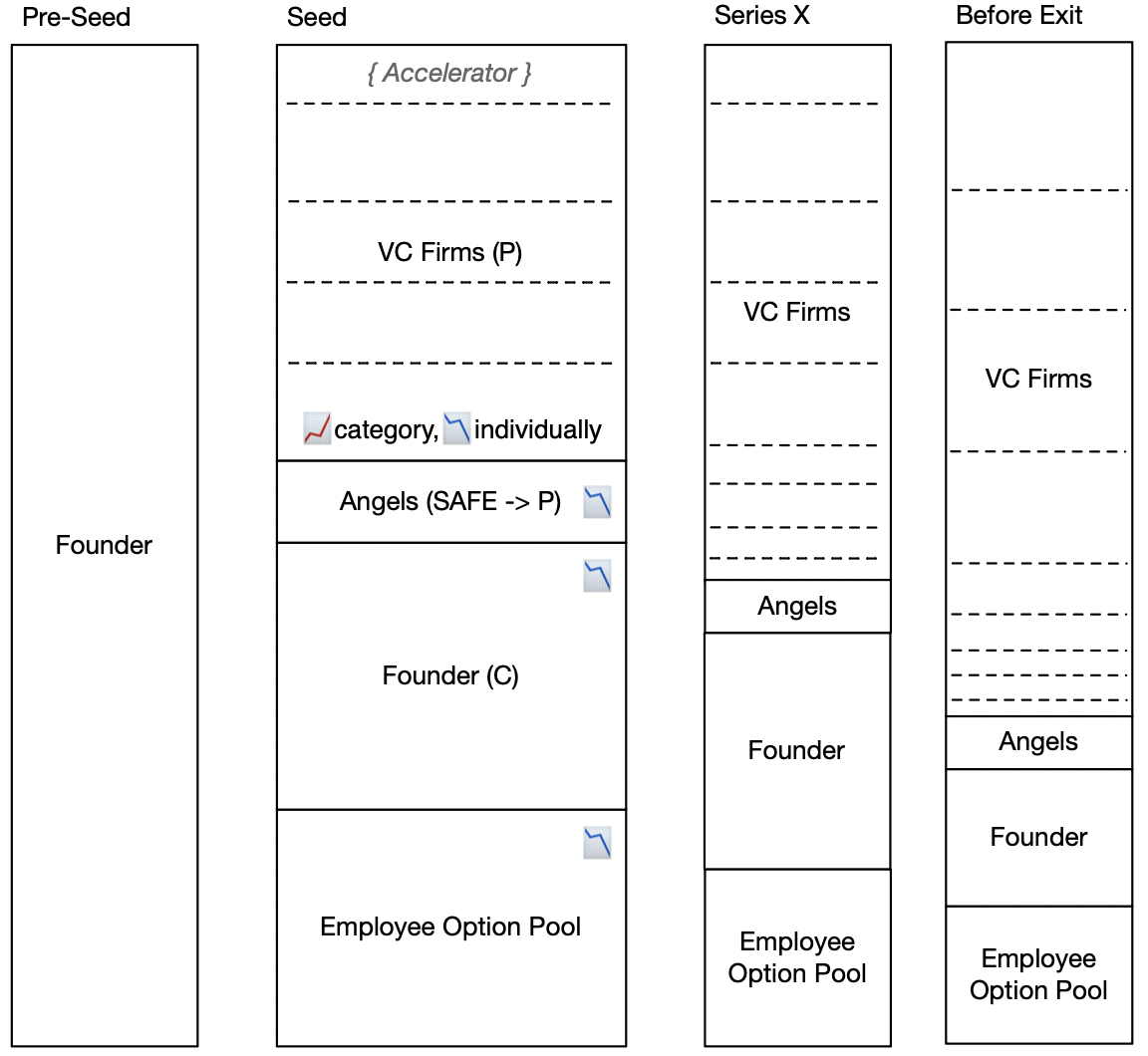

A Capitalization Table (or “Cap Table”) is a table – as in spreadsheet, not furniture – that conveys a company’s distribution of ownership.

In the beginning, a company is owned by its founders. As the company’s board trades away equity and control for capital, the allocation of the cap table generally tends towards an 80/20 split between capital risk-takers (VCs) and labor risk-takers (Founders + Employees), mirroring the 80/20 split between LPs and GPs (see What’s a VC Firm?)

Most capital risk is carried by LPs, through the shell of a VC Fund, which is managed by GPs in exchange for an annual % fee of assets under management and a proportion of total returns.

Some of the earliest-stage financial risk is additionally fronted by individually-wealthy investors (“Angels”), who exchange their capital, connections and expertise in exchange for a small proportion of equity in a company.

Finally, a vanishingly-small % of overall returns from VC-backed startups end up in the hands of people whose paid labor ultimately built the company, and who were typically not wealthy at the founding of that company.